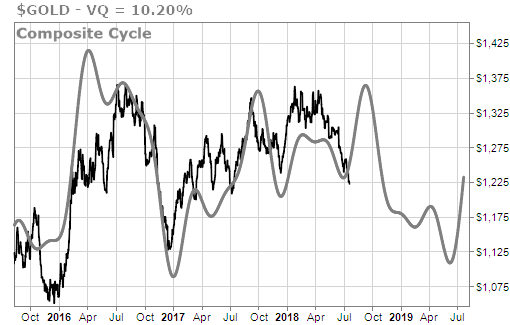

We started our bullish outlook on gold in late 2016. It had the makings of a really promising trade. There were several positive signals occurring at this time.

First it triggered a Stock State Indicator (SSI) — our primary diagnostic tool for stock health — Entry Signal in April 2017. At the time, the Volatility Quotient (VQ) for gold was 11.2%.

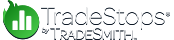

Another good signal was the “smart money” traders. In the gold futures market, the Commitment of Traders (COT) report showed that in the first half of 2016, the “smart money” sold contracts as gold began moving higher. The “smart money” includes many gold miners seeking to lock in profits on their future production when prices are high. Historically, as the number of short positions increases, we see an increase in the price of gold. This also happened in early 2017 and the middle of 2017.

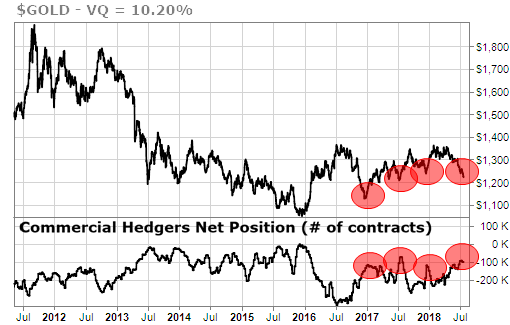

The next signal we looked at was our proprietary time-cycle forecast. Until recently, our forecast was uncannily accurate: it predicted gold’s rise into 2017 and again in 2018.

These are all great signs … so what happened?

The simplest explanation for what went wrong with the gold trade is that the U.S. dollar surged unexpectedly in 2018. The surge was a negative surprise for gold, and it overwhelmed all the other positive factors we mentioned.

You can see the USD’s strength via the U.S. Dollar Index chart as shown below.

As the world’s reserve currency, the U.S. dollar is the most popular and widely used form of “fiat” currency. Gold, meanwhile, is a safe-haven alternative to fiat currencies.

Because of that, gold and the dollar have an inverse relationship. When the dollar weakens, that tends to be a good thing for the gold price. And when the dollar strengthens, or even surges, that’s bad for the price.

We anticipated more dollar weakness — or at least a flat dollar — in 2018. But a rising trend of trade war fears, new fears of a European debt crisis via Italy, and other factors caused the dollar to become remarkably strong. That USD strength factor canceled out the other analysis points.

This happens sometimes: A new or unexpected surprise factor halts a major trend, or even causes that trend to go into reverse.

That happened with the dollar — as the USD got strong — and because of the negative correlation, the dollar’s strength ended the gold trade.

With that said, this kind of thing happens from time to time.

In markets you should “expect the unexpected,” which means surprises can change the picture or invalidate prior analysis.

That’s why factors like position sizing and risk management are so important. The idea is not to be 100% right on every trade, every single time. That is literally impossible.

The idea is to make smart investing and trading decisions, and to always position size correctly while managing risk … and then to profit from the total gains created by winning positions over time … while always making sure there are never any losing trades that get out of hand and cause significant damage to the portfolio.

In the case of gold, the factors were in our favor … but then one key factor (the trajectory of the U.S. dollar) changed in a surprising way. But we limited our exposure on the position and honored our risk point — thus preserving capital for future trades.

Maintaining longevity (the ability to stay in the game and focus on the next opportunity) is what it’s all about. That’s actually a more important lesson than why the gold trade went wrong.