Quick… who said, “It’s a huge structural advantage not to have a lot of money”?

If you guessed Warren Buffett, congratulations. Of course, I tipped my hand in the subject line, but I want to let that statement sink in.

When we compare ourselves to someone of Buffett’s stature, it’s easy to focus on the huge advantages he has over the rest of us.

None of us are ever likely to have as much money as Buffett. Buffett is never under any pressure to sell. He has money to buy when the time is right. And he can buy investments that we can never own.

Yet, Buffett himself says small investors have an advantage!

Here’s another quote from the same speech:

“The highest rates of return I’ve ever achieved were in the 1950s… I think I could make you 50% a year on a million. No, I know I could… I guarantee that.”

Now, maybe you don’t have a million. Maybe you’ve only got 5 or 6 figures to play with.

If you knew Buffett started with $5,000, how would that change your ideas of what’s possible?

Instead of looking at how much money Buffett manages, focus on how he manages his money. He still manages his money the same way that we can manage our money. And you have a huge advantage over the young Warren Buffett… You have TradeStops!

Here’s how you can use that advantage to model Buffett’s portfolio management style.

Confidence

TradeStops tools give you the confidence to stay invested in stocks that are trending higher and sell when the uptrend is no longer in effect.

A good example of this is available in the shareholder letter that Buffett just released this past weekend. In that letter, he told of a bet he had with an institutional money manager. He wagered a million dollars that the average individual investor could outperform a group of hedge fund managers.

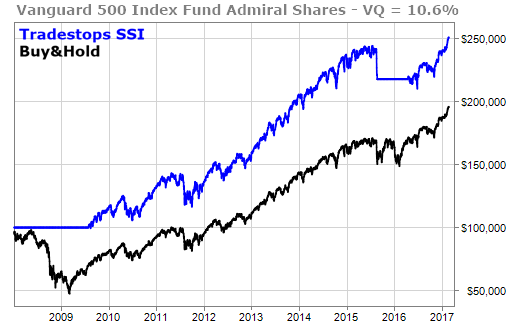

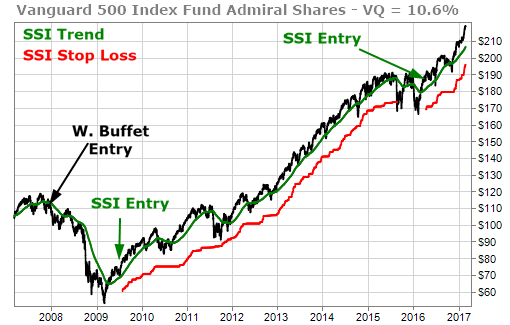

The wager was for a period of 10 years beginning January 1, 2008 and finishing on December 31, 2017. Buffett has already declared victory as the returns for the first 9 years of the Vanguard S&P 500 fund (VFIAX) have greatly outperformed the returns of the hedge funds.

TradeStops members could have done better!

This chart shows you the returns of the Vanguard S&P 500 fund that Buffett recommended. The black line is the original performance. The blue line shows how TradeStops’ tools would have performed by trading the exact fund using the Stock State Indicator (SSI) signals.

Using the TradeStops SSI signals would have resulted in a gain of 25% more than the gain of the S&P 500 fund itself.

Manage Risk

Warren Buffett is able to manage his risk through a multi-year process of examining companies and deciding what the right price is to buy them.

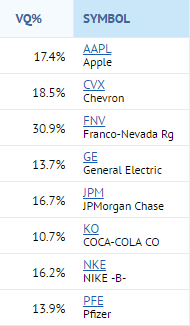

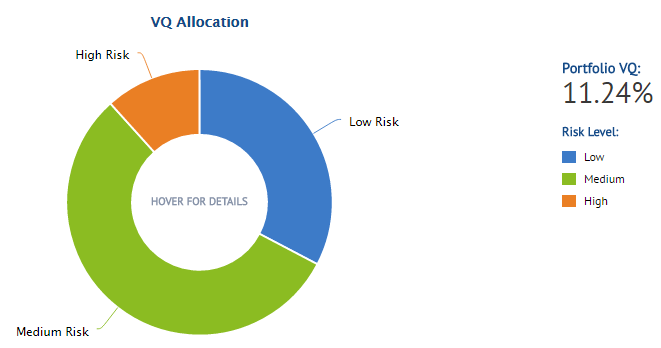

TradeStops members can manage the risk in their portfolios on two levels. First they can see the risk of the individual stocks they own through the Volatility Quotient (VQ).

They can then see the amount of risk that these stocks have as an overall portfolio through the Portfolio Volatility Quotient (PVQ).

Get the Signals

As an individual investor, you can enjoy the same agility that Warren Buffett displayed in his early 20s, when he was banking 60% per year. That’s because you don’t have to take weeks or months to enter or exit a position. The SSI Signals tell you the optimal time to get into a stock and exactly the best time to exit that stock.

As an individual investor, you can enjoy the same agility that Warren Buffett displayed in his early 20s, when he was banking 60% per year. That’s because you don’t have to take weeks or months to enter or exit a position. The SSI Signals tell you the optimal time to get into a stock and exactly the best time to exit that stock.

And these are the exact trades that would have occurred. There were two SSI Entry signals and, so far, only one SSI Stop signal.

Managing investments is not easy. Even Warren Buffett admitted that he doesn’t know when his stocks will go up. He just knows that if he’s patient, they will move higher.

TradeStops members can be patient as well. There is no need for excessive trading that can increase costs and decrease the overall returns.

Being like Buffett means risking less, and making more.